Small Loans, Big Problem

September 28, 2015

By

Community colleges are relatively affordable, and their students tend to borrow less than those who attend other types of institutions. Yet the debt students rack up at community colleges is troubling.

The reason is that students who attend two-year colleges struggle to repay even small loans, and often default on them, a concern that is reinforced by a new study from one of the sector’s primary trade groups — the Association of Community College Trustees.

Just 17 percent of community college students take out federal loans, the report said, which is much less than at four-year public institutions (48 percent), private colleges (60 percent) and for-profits (71 percent). But students who attend community colleges are more likely to default.

The national default rate for community college students three years after they enter repayment is 20.6 percent, the report said, compared to the overall average of 13.7 percent.

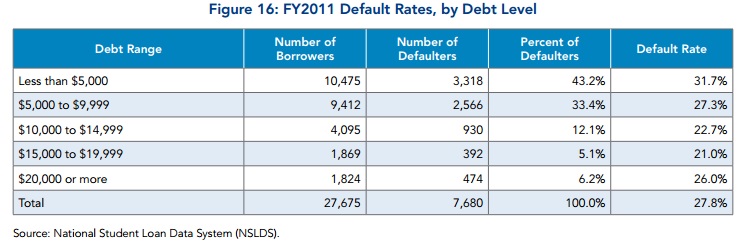

The association looked at how students are faring at Iowa’s 16 community colleges, and the picture isn’t pretty. Of the 27,675 Iowa community college students who entered repayment 4.5 years ago, 7,680 — or 27.8 percent — defaulted on their federal loans by January 2015.

The state’s community colleges are relatively expensive — annual tuition and fees are an average of $4,541 in Iowa, compared to the sector’s national average of $3,347. Borrowers in the sample took out an average of $8,287 in loans.

While the report is based on federal data, it pulled information that only is available to researchers at the U.S. Department of Education, colleges and federal lenders. The 16 Iowa colleges requested and shared the data. Using it to write the report were two researchers — Colleen Campbell, senior policy analyst at the association, and Nicholas Hillman, assistant professor of educational leadership and policy analysis at the University of Wisconsin at Madison.

They identified four key findings, which might be surprising to some:

(1) Students who borrow the least are the most likely to default.

A growing body of research has found that student loan defaults are concentrated among the millions of students who never earned a degree. Graduates who borrow the most tend to earn the most. But those who take on even a small amount of debt with nothing to show for it face a relatively high risk of defaulting.

This report bolsters that finding. Nearly half of the defaulters in the Iowa sample borrowed less than $5,000. Most borrowed less than $10,000. But the default rate for students who took out less than $5,000 in loans was nearly 32 percent. And it was 27 percent for students who took out $5,000 to $9,999 in loans.

(2) Most defaulters fail to earn a degree or complete many college credits.

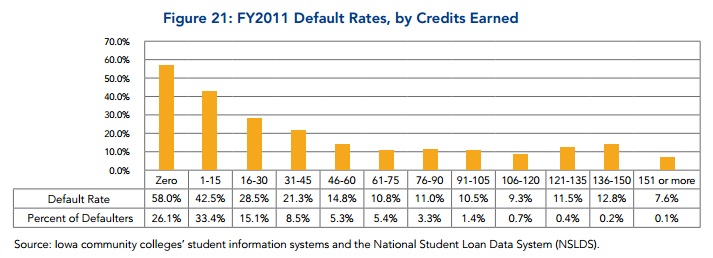

Almost 90 percent of students who defaulted left college with debt but no degree or certificate, according to the report. And roughly 60 percent of the defaulters were students who earned fewer than 15 college credits. About 26 percent of defaulters earned no credits at all — the zero-credit-holder group had a default rate of 58 percent. Students who earned up to 15 credits had a default rate of 43 percent.

In comparison, the report found that students who earned the most credits defaulted at the lowest rates. The default rate for students who earned 61 to 75 college credits — enough for an associate degree — was roughly 11 percent.

The report said fixing this problem won’t be easy, because community colleges have open-door admissions policies. Yet it called for policy solutions that promote “academic preparedness and progression,” while curbing borrowing by students in the earliest stages of enrollment. Also necessary are campuswide, data-driven interventions to help student stay enrolled and complete, according to the report.

(3) Many defaulters take no action on their debt.

Among borrowers who went into default, the report said nearly 60 percent did not use loan forbearance or deferment options. But while many did not postpone their payments, even more failed to make a single payment — fully two-thirds of defaulters made no payments on their loans.

Most students’ defaults occurred in the first year of repayment, the report found, and few borrowers dealt with their defaulted debt in the following 3.5 years.

The report cites research finding that students often underestimate how much they borrow, which could influence the large numbers who took no action on their debt. It is also possible that students did not know the terms of their debt, according to the report, and believed they had more flexible repayment options or did not have to repay their loans if they failed to graduate.

(4) Colleges lack complete information on federal loan data.

The National Student Loan Data System contains information on all federal student loans and most federal grants. While it gives financial aid administrators lots of helpful information, the report said the federal system allows little flexibility for data retrieval. Its student record pages are hard to interpret and include no information on loan servicer behavior.

As a result, counseling students and managing a loan portfolio is difficult for community colleges, the report said. And the lack of data on servicers makes appeals, challenges and “data-informed accountability almost impossible.”